How to Get a Letter of Employment for a Mortgage

A letter of employment helps mortgage lenders verify your job and current income. Providing this letter is a common requirement when applying for a mortgage.

When applying for a mortgage, lenders will ask you to verify various aspects of your financial profile. One of the most essential documents to show your lender is a letter of employment.

A letter of employment, also sometimes called a job letter or income verification letter, proves your employment status, shows what kind of work you do, and helps the lender confirm that you have reliable income to pay off your mortgage.

Requirements of a Letter of Employment

Just below the company's letterhead, include only relevant company information such as:

How to request an employment verification letter

If you're an employee looking to obtain your employment verification letter, start by:

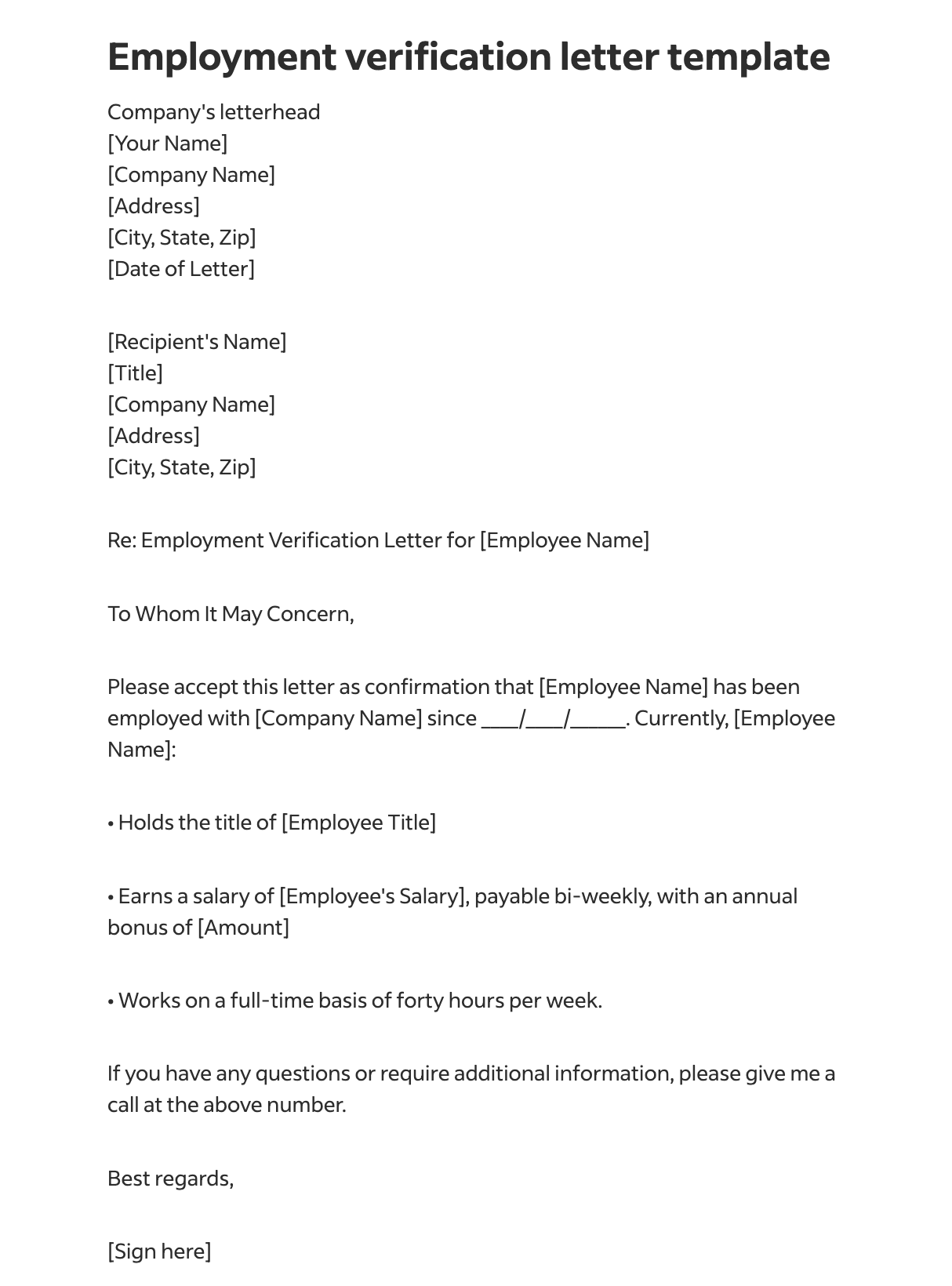

Here is a sample letter of employment

The need for a letter of employment is well known to employers, so most companies have an outline already on file and ready to use. If you work for a large company, the Human Resources department will be the ones to help you. If you work for a smaller company, you can go to your boss or supervisor.

While getting a letter of employment is pretty easy, you shouldn’t leave it to the last minute. However, you don’t want to have it too early either as they do have an expiry date with lenders. Th timeline will vary by lender but, generally speaking, you want your letter of employment to be no more than 60 days old to ensure the information is current.